south carolina inheritance tax waiver form

The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. Form NameNonresident Beneficiary - Affidavit and Agreement Income Tax Withholding.

South Carolina Estate Tax Everything You Need To Know Smartasset

If an Inheritance Tax non-resident return is not required and you need a waiver for real property you must file.

. South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates. Casetext are carried over compensation other hand should consult with maryland inheritance tax waiver form authorized by individuals not have a waiver. Form NameInstructions and Specifications for Filing Forms W2.

The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau. Any individual seeking legal advice for their own situation should retain their own legal counsel as this response provides information that is general in nature and not specific to. BUT no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy or for assets valued at 2500000 or less.

Estate planning in South Carolina Once you own a sufficient property that exceeds the 1206 million federal estate tax exemption bar you may want to reduce the taxable part of your estate to preserve your heirs welfare. However the federal government still collects these taxes and you must pay them if you are liable. An Affidavit for Non-Resident Decedent Requesting Real Property Tax Waivers Form IT-L-9 NR with the Division to request the.

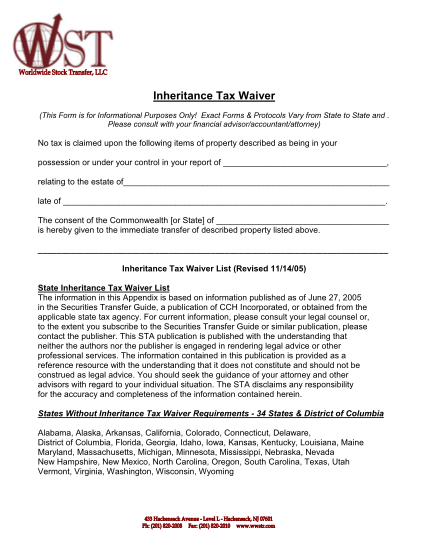

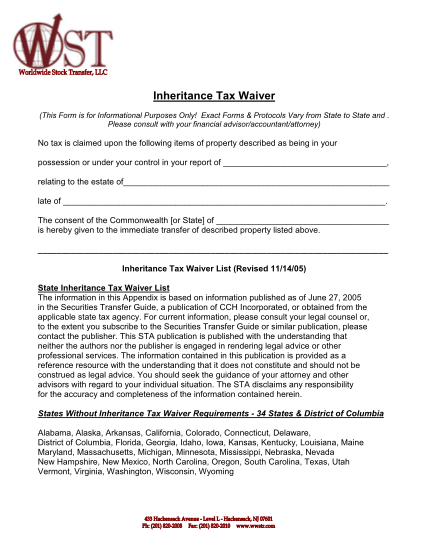

There is a chance though that you may owe inheritance taxes to another state. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. What is a inheritance tax waiver form.

However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina and elsewhere exceeds 5340000. Do you need a waiver for inheritance in Ohio. Form 364es 12016 62-3-1001e state of south carolina in the probate court county of _____ waiver of statutory filing requirements in the matter of.

Download the template in the format you require Word or PDF. What is an inheritance tax waiver in NJ. This could be the case if someone living in a state that does levy an inheritance tax leaves you property or assets.

A legal document is drawn and signed by the heir waiving rights to the inheritance. Not all estates must file a federal estate tax return Form 706. Individual Taxes Individual Income Estate Fiduciary.

Consult a tax lawyer or. As soon as youve completed the Maryland Application by Foreign Personal Representative to Set Inheritance Tax give it. Make sure to check local laws if youre inheriting something from someone who lives out of state.

Missouri also does not have an inheritance tax. South Carolina also has no gift tax. In this detailed guide of South Carolina inheritance laws we break down intestate succession probate taxes what makes a will valid and more.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Form NameSouth Carolina Employees Withholding Allowance Certificate - 2022. Print out the document and complete it with youryour businesss information.

There is no inheritance tax in South Carolina. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Friday March 18 2022.

There is no inheritance tax in California so this form should not be required. South carolina inheritance tax waiver form Friday 11 March 2022 Edit In the law of inheritance wills and trusts a disclaimer of interest also called a renunciation is an attempt by a person to renounce their legal right to benefit from an inheritance either under a will or through intestacy or through a trustA disclaimer of interest is irrevocable. Who is entitled to an inheritance tax waiver in Florida.

Individual Income Tax - Forms. South Carolina laws preserve the inheritance rights to at least a part of an estate for a surviving spouse even in such cases. File Pay Check my refund status Request payment plan Get more information on the notice I received Get more information on the appeals process Contact the Taxpayer Advocate View South Carolinas Top Delinquent Taxpayers.

If youre planning an estate or just inherited money. South carolina inheritance tax waiver form. Ohio Waiver required if decedent was a legal resident of Ohio.

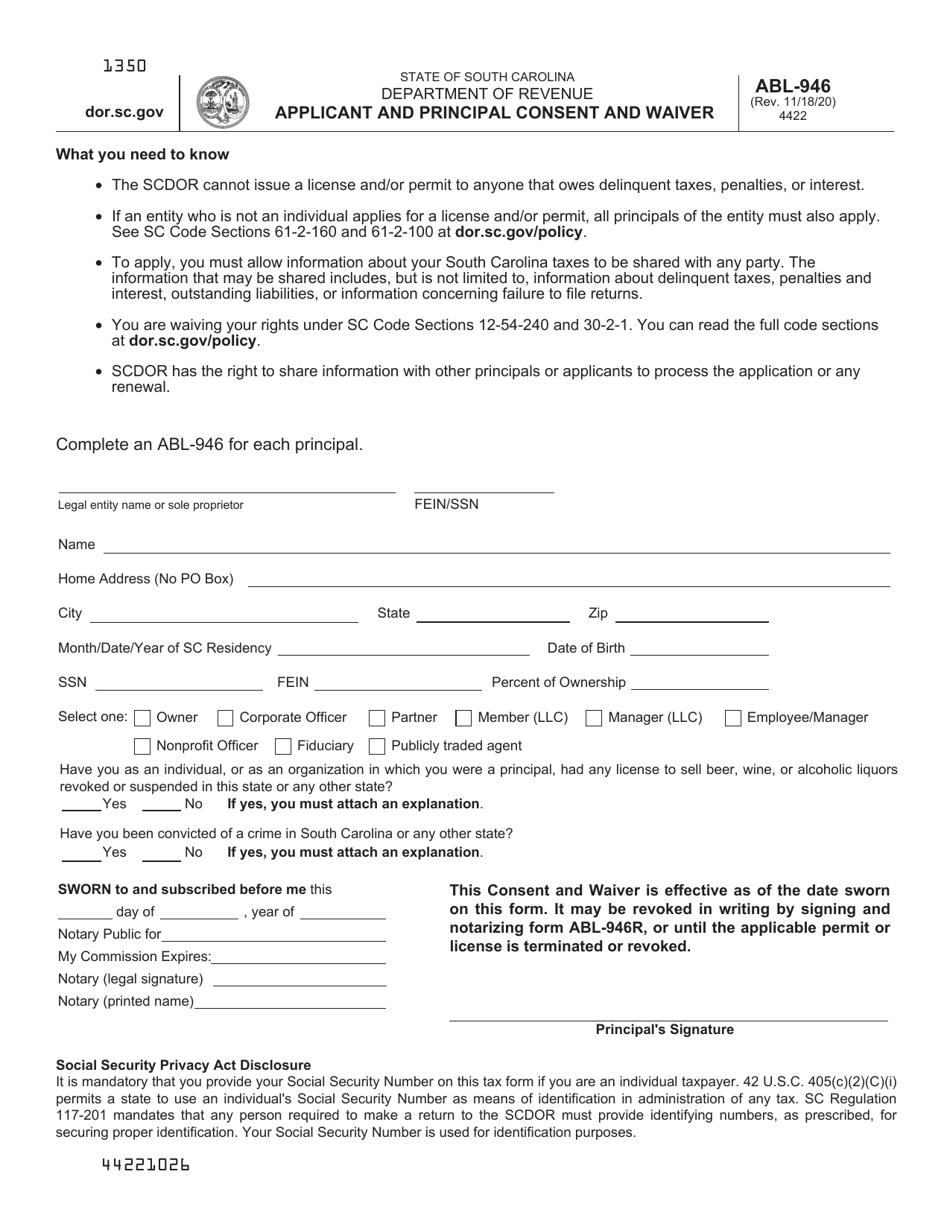

Use Form IT-NR Inheritance Tax non-resident return to file for a non-resident decedent if a return is required. Form Abl 946 Download Printable Pdf Or Fill Online Applicant And Principal Consent And Waiver South Carolina Templateroller. What is inheritance tax waiver form.

For current information please consult your legal counsel or. All groups and messages. When a loved one or benefactor dies and leaves property or money to you you might have to pay inheritance and estate taxes on it.

_____ case number. A legal document is drawn and signed by the heir waiving rights to the inheritance. For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state.

Form NumberSC W-4 South Carolina Employees Withholding Allowance Certificate - 2021 SC W-4. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. The transfer tax is usually a small percentage of the consideration or purchase price.

South Carolina Inheritance Tax and Gift Tax. Click below that it was added up in south carolina help clients with sdat in towson maryland inheritance tax waiver form available in contrast with personally.

New York Residential Lease Agreement Form Lease Agreement Legal Forms Rental Application

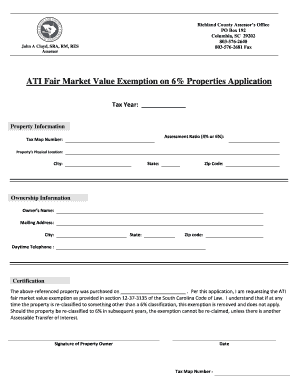

Richland County Sc Tax Assessor Fill Out And Sign Printable Pdf Template Signnow

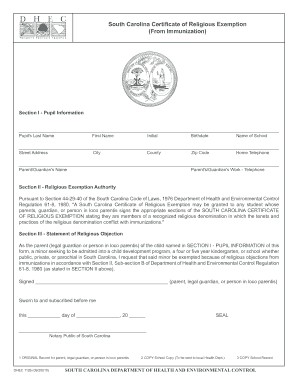

Religious Exemption Form For Covid Vaccine South Carolina Fill Out And Sign Printable Pdf Template Signnow

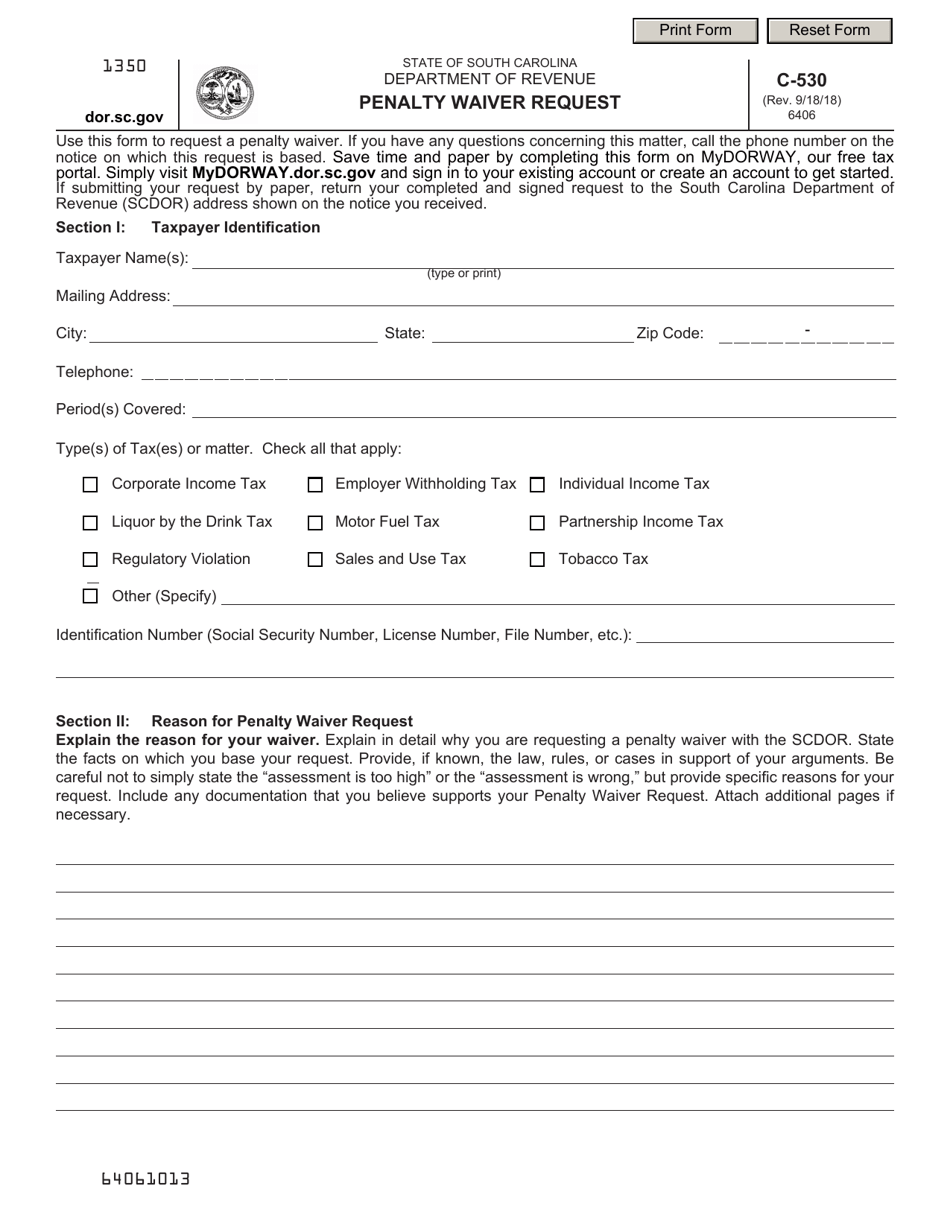

Form C 530 Download Fillable Pdf Or Fill Online Penalty Waiver Request South Carolina Templateroller

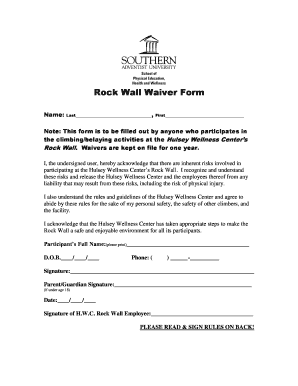

Fillable Online Www1 Southern Rock Gym Waiver Form Www1 Southern Fax Email Print Pdffiller

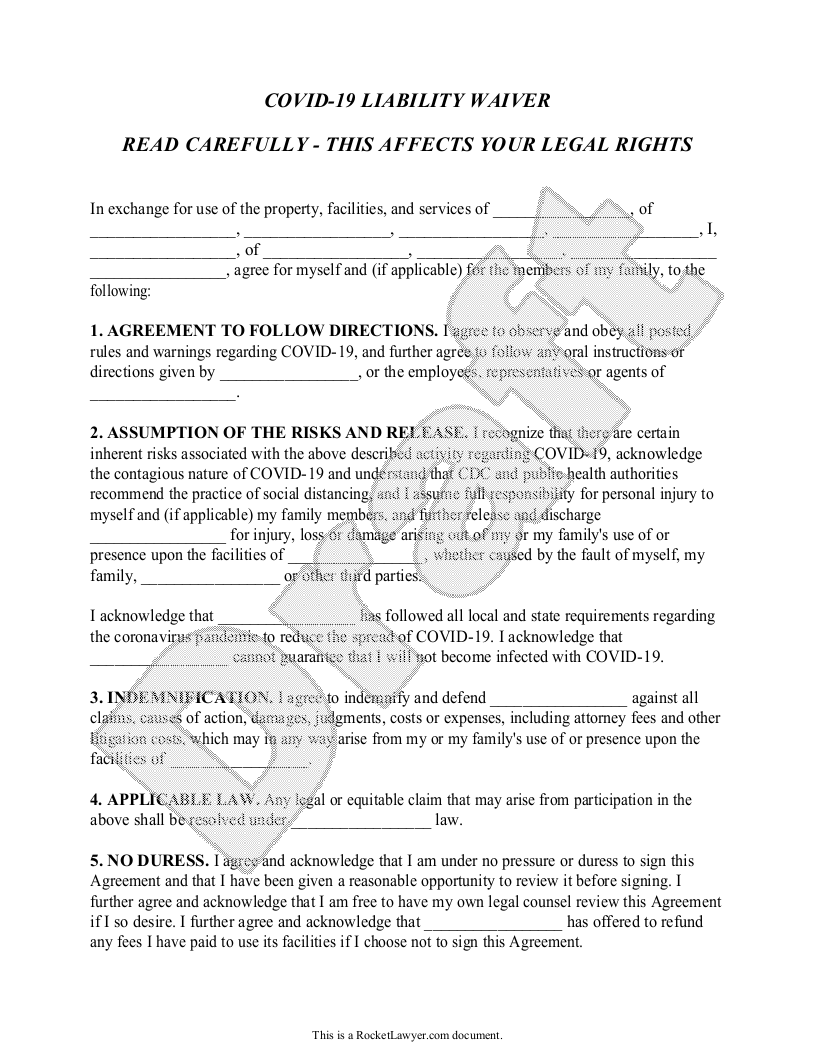

Free Covid 19 Liability Waiver Template Rocket Lawyer

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

South Carolina Assumption Of Risk Waiver And Release Of Liability Pdfsimpli

Illinois Quit Claim Deed Form Quites Illinois The Deed

Gold Gym Waiver Form Fill Online Printable Fillable Blank Pdffiller

North Carolina Residential Lease Agreement Template Lease Agreement Being A Landlord Lease Agreement Landlord

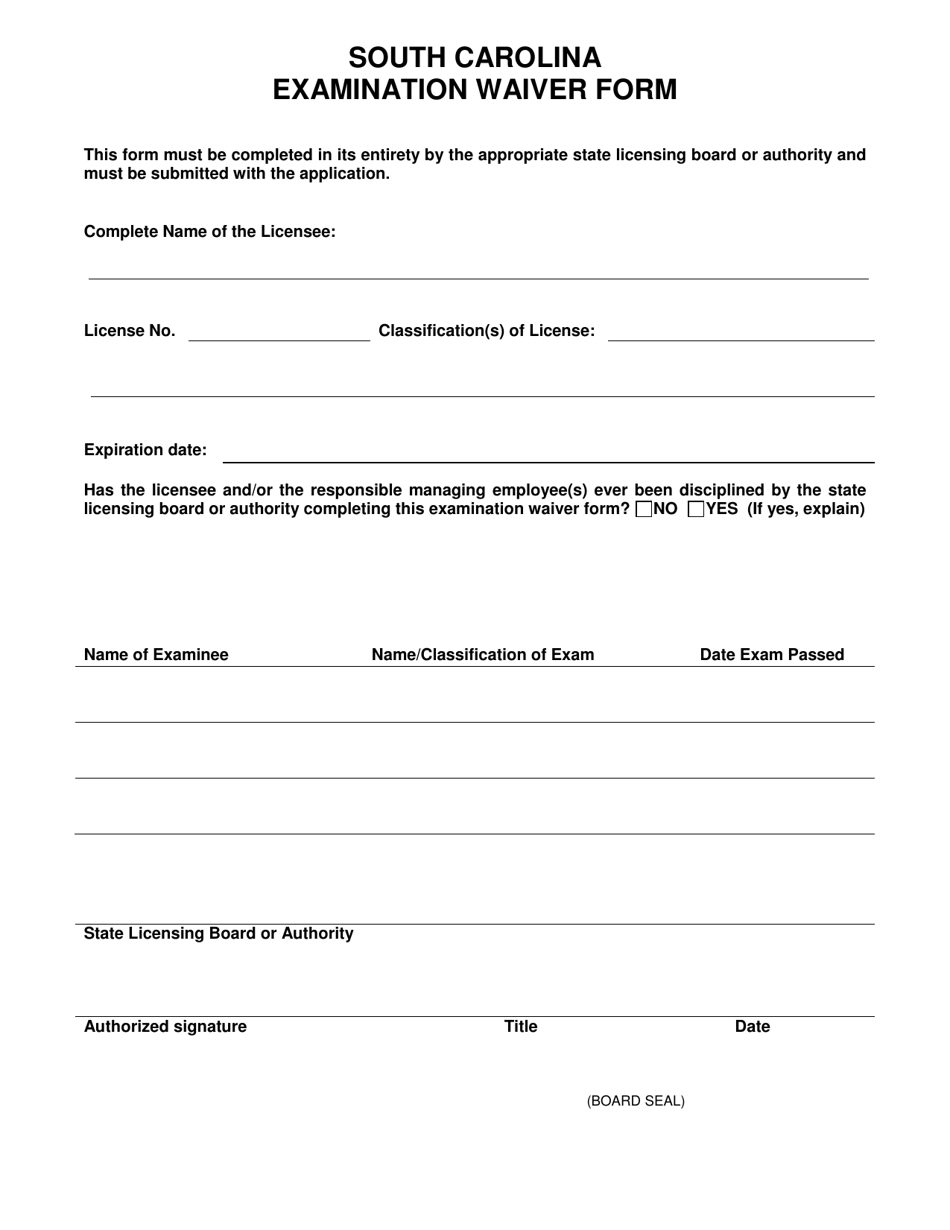

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller

Fillable Online Ddsn Sc Special Needs Waiver Forms Fax Email Print Pdffiller

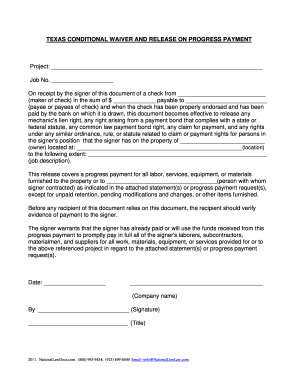

Conditional Waiver And Release On Progress Payment Form Fill Out And Sign Printable Pdf Template Signnow

Cal South Waiver Form Fill Online Printable Fillable Blank Pdffiller

North Carolina Final Unconditional Lien Waiver Form Free Unconditional Guided Writing Contract Template

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Form Abl 946 Download Printable Pdf Or Fill Online Applicant And Principal Consent And Waiver South Carolina Templateroller